All Categories

Featured

Table of Contents

You then buy the automobile with cash money. Infinite Banking account setup. The debate made in the LIFE180 video clip is that you never ever obtain anywhere with a sinking fund. You deplete the fund when you pay money for the cars and truck and replenish the sinking fund only to the previous level. That is a massive misunderstanding of the sinking fund! The cash in a sinking fund makes passion.

That is how you stay on par with rising cost of living. The sinking fund is always growing via rate of interest from the conserving account or from your vehicle repayments to your vehicle sinking fund. It additionally happens to be what unlimited financial comfortably fails to remember for the sinking fund and has superb recall when put on their life insurance product.

That, we are informed, is the increase in our cash value in year two. The actual brag should be that you contributed $220,000 to the boundless financial policy and still only have a Money Worth of $207,728, a loss of $12,272 up to this factor

What is Infinite Banking Retirement Strategy?

You still have a loss no matter what column of the forecast you use.

Now we turn to the longer term rate of return with boundless financial. Prior to we disclose truth long-lasting rate of return in the entire life policy forecast of a promoter of limitless financial, allow's ponder the concept of connecting a lot money up in what in the video is called an interest-bearing account.

The only method to transform this into a win is to use malfunctioning math. First, assess the future worth calculator listed below.

Infinite Banking Concept

The concept is to get you to believe you can make money on the cash borrowed from your unlimited banking account while concurrently gathering an earnings on various other investments with the very same money. When you take a loan from your entire life insurance coverage plan what truly took place?

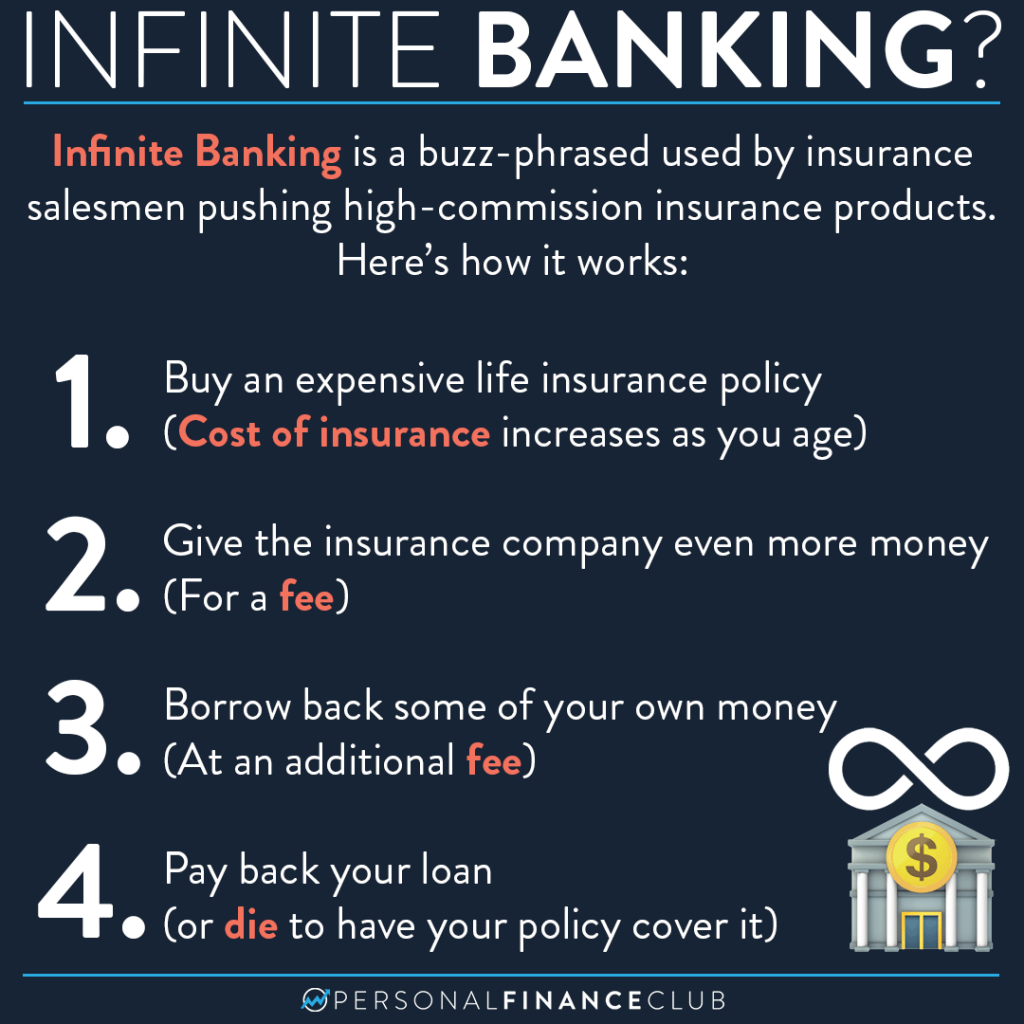

The cash money worth belongs to the insurer. It doesn't belong to you. The "appropriately structured whole life policy" bandied about by vendors of unlimited banking is actually simply a life insurance policy business that is owned by insurance policy holders and pays a dividend. The only reason they pay a dividend (the rate of interest your cash worth makes while obtained out) is since they overcharged you for the life insurance coverage.

By utilizing a whole life policy, families can fund major life expenses.

Unlike traditional savings accounts, Infinite Banking offers uninterrupted compound interest.

Family wealth strategists assist in structuring Infinite Banking policies - how to make money with infinite banking. Schedule a consultation today to pass down wealth effectively

Each insurer is various so my instance is not an excellent suit to all "properly structured" limitless financial instances. It functions like this. When you obtain a finance of "your" cash money worth you pay rate of interest. THIS IS AN ADDITIONAL FINANCING OF YOUR LIMITLESS BANKING ACCOUNT AND NOT EXPOSED IN THE PICTURE! Envision if they would certainly have added these quantities to their sinking fund example.

What is the long-term impact of Self-financing With Life Insurance on my financial plan?

Also if the insurance business credited your cash money value for 100% of the passion you are paying on the lending, you are still not obtaining a cost-free experience. Infinite Banking cash flow. YOU are spending for the rate of interest credited to your money value for the amounts lent out! Yes, each insurance provider whole life plan "effectively structured" for infinite banking will differ

When you pass away, what happens with your entire life insurance coverage policy? Bear in mind when I pointed out the car loan from your money worth comes from the insurance policy companies general fund? Well, that is because the cash money value belongs to the insurance coverage firm.

I can go on, yet you obtain the point. There are lots of deadly defects to the limitless banking principle. Life insurance policy business and insurance coverage representatives like the principle and have adequate factor to be blind to the achilles' heels. In the long run there are just a couple of reasons for utilizing permanent life insurance and limitless banking is not one of them, regardless of just how "appropriately" you structure the policy.

The following method is a variant of this method where no financial debt is essential. Here is just how this strategy functions: You will need a home mortgage and line of credit scores.

How does Infinite Banking Account Setup compare to traditional investment strategies?

Your normal mortgage is now paid down a little bit greater than it would certainly have been. Rather than maintaining greater than a token amount in your monitoring account to pay costs you will certainly drop the cash right into the LOC. You currently pay no interest since that amount is no longer obtained.

If your LOC has a greater rate of interest rate than your home mortgage this strategy runs right into problems. If your home mortgage has a greater rate you can still utilize this method as long as the LOC passion rate is similar or reduced than your mortgage passion rate.

Limitless financial, as advertised by insurance coverage representatives, is made as a huge financial savings account you can obtain from. As we saw above, the insurance business is not the warm, fuzzy entity handing out free money.

If you eliminate the insurance company and invest the very same cash you will certainly have extra because you don't have middlemen to pay. And the interest price paid is possibly higher, depending on existing passion prices.

How can Policy Loan Strategy reduce my reliance on banks?

You can withdraw your cash any time. You can always call it borrowing your very own cash if you want. The same principle works with cash markets accounts at banks (financial institutions or lending institution). Here is the magic of unlimited financial. When you obtain your own cash you additionally pay yourself a rate of interest rate.

Latest Posts

5 Steps To Be Your Own Bank With Whole Life Insurance

Infinite Banking Policy

How To Be Your Own Bank With Whole Life Insurance