All Categories

Featured

Table of Contents

If you take a distribution versus your account before the age of 59, you'll also need to pay a 10% fine. The IRS has actually imposed the MEC regulation as a method to avoid people from skirting tax obligations. Unlimited financial only functions if the money worth of your life insurance policy policy stays tax-deferred, so ensure you don't turn your plan into an MEC.

As soon as a money value insurance policy account categorizes as an MEC, there's no method to reverse it back to tax-deferred condition. Infinite financial is a practical principle that supplies a variety of advantages.

You can enjoy the advantages of limitless banking with a variable global life insurance policy plan or an indexed global life insurance policy policy. However given that these kinds of plans link to the stock exchange, these are not non-correlated assets. For your plan's cash money worth to be a non-correlated asset, you will certainly need either entire life insurance or universal life insurance policy.

Before picking a policy, find out if your life insurance coverage company is a shared business or not, as just mutual firms pay dividends. You will not have to dip into your cost savings account or search for lending institutions with low-interest rates.

How does Wealth Management With Infinite Banking compare to traditional investment strategies?

By taking a financing from you instead of a conventional lending institution, the borrower can conserve countless dollars in interest over the life of the car loan. (Simply be sure to charge them the same interest rate that you need to repay to yourself. Or else, you'll take a monetary hit).

Due to the fact that of the MEC law, you can not overfund your insurance coverage plan also much or also quickly. It can take years, if not decades, to develop a high cash money worth in your life insurance coverage plan.

A life insurance policy connections to your wellness and life expectations. Depending on your medical background and pre-existing conditions, you might not qualify for an irreversible life insurance coverage policy at all. With boundless financial, you can become your very own banker, borrow from yourself, and add cash money value to a permanent life insurance plan that grows tax-free.

When you first hear concerning the Infinite Financial Idea (IBC), your very first reaction may be: This sounds too great to be real - Whole life for Infinite Banking. The trouble with the Infinite Banking Concept is not the principle but those individuals using an adverse review of Infinite Banking as a principle.

So as IBC Authorized Practitioners through the Nelson Nash Institute, we thought we would certainly respond to a few of the top inquiries individuals search for online when learning and comprehending everything to do with the Infinite Banking Concept. So, what is Infinite Banking? Infinite Banking was produced by Nelson Nash in 2000 and fully clarified with the publication of his publication Becoming Your Own Lender: Unlock the Infinite Banking Principle.

Is Financial Independence Through Infinite Banking a good strategy for generational wealth?

You assume you are coming out economically ahead since you pay no interest, however you are not. With saving and paying money, you may not pay passion, however you are using your cash when; when you spend it, it's gone for life, and you provide up on the possibility to earn life time compound interest on that cash.

Billionaires such as Walt Disney, the Rockefeller family and Jim Pattison have actually leveraged the residential or commercial properties of whole life insurance coverage that dates back 174 years. Also banks utilize entire life insurance coverage for the very same purposes.

What financial goals can I achieve with Generational Wealth With Infinite Banking?

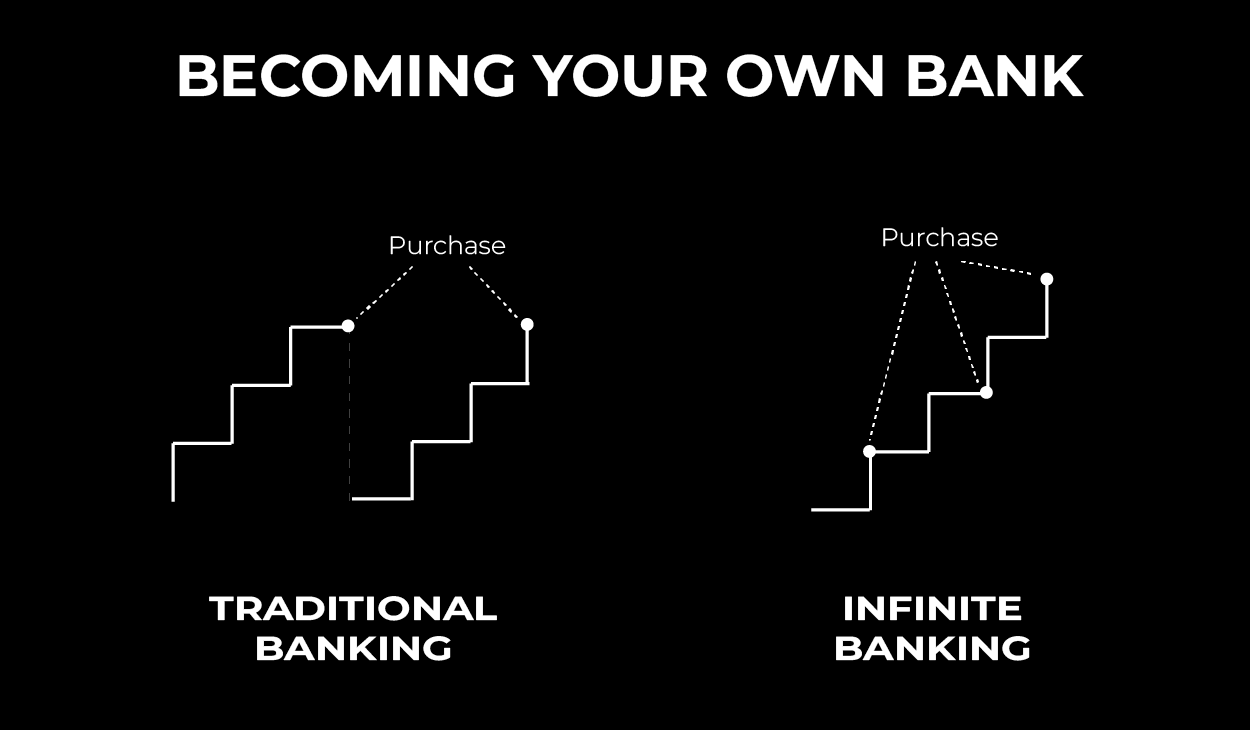

It permits you to generate wealth by meeting the banking function in your very own life and the capability to self-finance major way of life acquisitions and costs without interrupting the substance interest. Among the simplest methods to consider an IBC-type getting involved whole life insurance policy plan is it approaches paying a home mortgage on a home.

When you obtain from your getting involved entire life insurance plan, the cash money worth continues to grow continuous as if you never obtained from it in the very first place. This is because you are utilizing the cash money worth and death benefit as collateral for a financing from the life insurance company or as collateral from a third-party lender (known as collateral lending).

That's why it's imperative to deal with a Licensed Life insurance policy Broker authorized in Infinite Financial who frameworks your getting involved entire life insurance policy plan appropriately so you can stay clear of adverse tax ramifications. Infinite Financial as a financial method is except everyone. Right here are some of the advantages and disadvantages of Infinite Banking you ought to seriously consider in determining whether to move on.

Our preferred insurance policy provider, Equitable Life of Canada, a common life insurance policy firm, concentrates on getting involved entire life insurance policy plans certain to Infinite Financial. Also, in a common life insurance company, insurance policy holders are thought about company co-owners and get a share of the divisible surplus generated annually with dividends. We have a range of service providers to choose from, such as Canada Life, Manulife and Sunlight Lifedepending on the requirements of our customers.

What is the long-term impact of Infinite Banking For Retirement on my financial plan?

Please likewise download our 5 Leading Questions to Ask A Boundless Financial Representative Prior To You Employ Them. To find out more concerning Infinite Financial go to: Please note: The product supplied in this e-newsletter is for informative and/or academic functions just. The information, viewpoints and/or sights expressed in this e-newsletter are those of the writers and not always those of the representative.

Latest Posts

5 Steps To Be Your Own Bank With Whole Life Insurance

Infinite Banking Policy

How To Be Your Own Bank With Whole Life Insurance