All Categories

Featured

Table of Contents

- – What are the benefits of using Infinite Bankin...

- – What makes Infinite Banking For Financial Free...

- – How long does it take to see returns from Fin...

- – Can Infinite Banking Vs Traditional Banking p...

- – What are the benefits of using Wealth Buildi...

- – How does Cash Value Leveraging create financ...

Why not treat yourself the exact very same way? The idea of Infinite Banking works only if you treat your individual bank the exact same way you would certainly a regular bank. You can also make use of fundings for one of one of the most important points, which is taxes. As a company owner, you pay a great deal of money in taxes, whether quarterly or each year.

That method, you have the cash to pay taxes the following year or the following quarter. If you intend to find out more, have a look at our previous short articles, where we cover what the tax benefits of an entire life insurance plan are. Infinite Banking and just how you can pay taxes through your system

You can easily lend cash to your organization for expenditures. After that, you can pay that money back to yourself with personal rate of interest.

What are the benefits of using Infinite Banking Cash Flow for personal financing?

We used our dividend-paying life insurance policy to purchase a property in the Dominican Republic. It's not enough to just learn regarding cash; we need to recognize the psychology of cash.

Get a lorry on your own, your youngsters, or your prolonged household. We bought an automobile for concerning $42,000. You might be wondering how. Well, we used our entire life the very same means we would if we were to fund it from a financial institution. We had a mid- to low-level credit rating at the time, and the rate of interest on that particular car would be around 8%.

What makes Infinite Banking For Financial Freedom different from other wealth strategies?

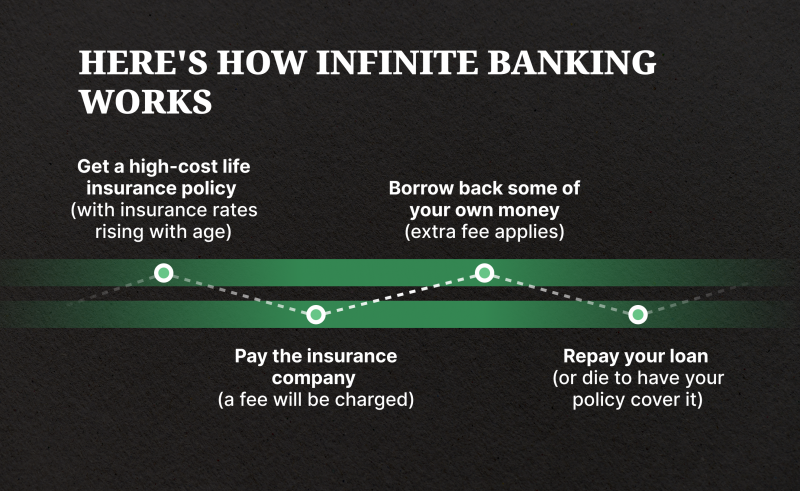

Infinite Financial is copying the standard financial procedure, however you're capturing interest and expanding cash as opposed to the financial institutions. The amount of people are burdened with medical costs that we often can not pay? We wind up charging them on a bank card and making month-to-month payments back to that card with principal and passion.

Among the most effective methods to utilize Infinite Financial is to pay for your financial obligation. Pay on your own back that principal and rate of interest that you're repaying to the bank, which is substantial. When we first began our financial system, it was due to the fact that we wished to erase our financial obligation. Infinite Financial offers you control over your financial functions, and after that you really begin to check out the cash in different ways.

Are you thinking about doing the same? Maintain reviewing this post and we will certainly reveal you exactly how. How lots of people are burdened with trainee fundings? You can pay off your student financial debt and ensure your kids' university tuition many thanks to your entire life plan's money value. Whatever we suggest right here is since we know individuals are currently doing it themselves.

How long does it take to see returns from Financial Independence Through Infinite Banking?

Again, the excellent aspect of Infinite Banking is that the insurer does not ask you, "What is this cash for?" That permits you to use it for whatever you want. You can utilize your financings for a selection of various points, however in order for Infinite Financial to work, you need to ensure that you comply with the 3 regulations: Pay on your own initially; Pay on your own rate of interest; Recapture all the money so it returns to you.

Most importantly, you can make use of Infinite Banking to finance your very own way of living. You can be your own lender with a lifestyle financial technique.

Can Infinite Banking Vs Traditional Banking protect me in an economic downturn?

With a whole life insurance policy policy, we have no risk, and anytime we understand what is happening with our money due to the fact that just we have control over it. Where life insurance policy company should I obtain my whole life plan? It will depend on where you live. But the only point you should keep in mind is to obtain your whole life insurance plan from among the common insurance provider.

When you put your cash right into banks, for you, that money is just sitting there. It suggests the amount you place in expands at a specific rate of interest, but just if you don't use it. If you require your money for something, you can access it (under some conditions), however you will certainly interrupt its growth.

What are the benefits of using Wealth Building With Infinite Banking for personal financing?

To put it simply, your money is helping financial institutions make more money. So, you can not develop riches with normal financial institutions because they are doing it rather than you. Yet,.

This enables you to become your very own banker and have even more control over your money. You can find out the limitless banking benefits and drawbacks to see if this strategy is an excellent fit for you and your company. One of the benefits is that you can make compound interest on the funds in your plan, which can possibly expand at a greater rate than standard interest-bearing accounts.

This is particularly valuable for company owner who intend to give their company or leave a considerable amount of wealth for future generations. Versatility and control: As the plan proprietor, you have full control over how you use the money worth in your whole life insurance coverage plan. You can pick when to access the funds, exactly how much to obtain, and exactly how to use them.

We will certainly explore how infinite banking works, its benefits, the process of setting up a policy, the threats and restrictions, and options available (Cash flow banking). This blog site will give you with basic details to comprehend the Infinite Financial Idea (IBC) here in Canada. Sorry, your internet browser doesn't sustain embedded videos. The Infinite Financial Concept is an economic strategy that has acquired popularity in recent times, specifically in Canada.

How does Cash Value Leveraging create financial independence?

The advantage of this method is that the rates of interest paid is usually similar to what a financial institution would certainly charge on a comparable loan, is often tax obligation deductible (when made use of for financial investment functions as an example) and the financing can be repaid at any kind of time with no charge. Furthermore, by borrowing from the policy's cash money value a person can build a self-funded source of resources to cover future expenditures (ie turning into one's very own banker).

It is vital to recognize that limitless banking is not a one-size-fits-all technique. The efficiency of unlimited financial as a cost savings plan relies on different elements such as a person's monetary standing and more. Unlimited financial is a financial concept that entails using an entire life insurance policy policy as a savings and investment automobile.

It is very important to recognize the structure and kind of Whole Life plan designed to maximize this approach. Not all Whole Life policies, even from the same life insurance company are made the same. Whole life insurance is a kind of long-term life insurance policy that gives insurance coverage for the entire lifetime of the insured individual.

This supplies the plan owner reward alternatives. Reward alternatives in the context of life insurance policy refer to exactly how insurance holders can pick to utilize the returns generated by their whole life insurance policy plans. Rewards are not guaranteed, nevertheless, Canada Life for instance, which is the earliest life insurance firm in Canada, has not missed out on a reward payment since they initially established a whole life policy in the 1830's before Canada was even a country! Right here are the common returns choices readily available:: With this option, the insurance policy holder uses the rewards to buy extra paid-up life insurance coverage.

Table of Contents

- – What are the benefits of using Infinite Bankin...

- – What makes Infinite Banking For Financial Free...

- – How long does it take to see returns from Fin...

- – Can Infinite Banking Vs Traditional Banking p...

- – What are the benefits of using Wealth Buildi...

- – How does Cash Value Leveraging create financ...

Latest Posts

5 Steps To Be Your Own Bank With Whole Life Insurance

Infinite Banking Policy

How To Be Your Own Bank With Whole Life Insurance

More

Latest Posts

5 Steps To Be Your Own Bank With Whole Life Insurance

Infinite Banking Policy

How To Be Your Own Bank With Whole Life Insurance